THE FORTNIGHTLY

A Review of Middle East Regional Economic & Cultural News & Developments

25 December 2019

27 Kislev 5780

28 Rabi ul Akhar 1441

Written & Edited by Seth J. Vogelman*

TABLE OF CONTENTS:

1: ISRAEL GOVERNMENT ACTIONS & STATEMENTS

1.1 Israel to Establish $4 Million Innovation Lab in Haifa for Environmental Tech

1.2 Israel, Cyprus & Greece to Sign Landmark Gas Pipeline Deal on 2 January

1.3 Israel Approves Gas Exports to Egypt

1.4 Israel’s National Infrastructure Committee Approves Construction of 6th Desalination Plant

1.5 Top Officials of 11 U.S. States Visiting Israel with AJC Project Interchange

1.6 Tel Aviv Imposing Stiff E-Scooter Restrictions as Injuries Mount

2: ISRAEL MARKET & BUSINESS NEWS

2.1 Scope AR Acquires Augmented Reality Toolset Company WakingApp

2.2 WeBuy Partners with ExitValley to Launch Their Equity Funding Round

2.3 Stifel Opens Israel Office

2.4 Intel Acquires Artificial Intelligence Chipmaker Habana Labs

2.5 Satori Cyber Raises $5.25 Million to Deliver Industry’s First Secure Data Access Cloud

2.6 Arbe Raises $32 Million for High-Definition Radar Chipset for ADAS & Autonomous Vehicles

2.7 E-Scooter Firm Lime Issues Call For Safety Innovation Proposals from Israeli Startups

2.8 Tel Aviv Stock Exchange Seeks To Improve Transparency & Broaden Appeal

2.9 Gloat Secures $25 Million in Series B Funding from Eight Roads and Intel Capital

2.10 Atrinet – Lenovo Strategic Partnership to Accelerate Transition to Open Networking

2.11 BIRD Energy to Invest $6.4 Million in Cooperative Israel-U.S. Clean Energy Projects

2.12 MusashiAI Launches World’s First Robot Employment Agency

2.13 OTI Raises $2.5 Million from Investors

3: REGIONAL PRIVATE SECTOR NEWS

3.1 HALO Maritime Opens Headquarters Office in Bahrain

3.2 Inventus Power Establishes Manufacturing Operations in Qatar Free Zones

3.3 Emirates Healthcare Development Company Raises $150 Million to Fund Centers of Excellence

3.4 Floranow Closes $3 Million Series A Round Led by Wamda and Global Ventures

3.5 VentureSouq Invests in Insurance Platform Vouch

3.6 Carzaty Launches in UAE with $4 Million in Funding

3.7 Sabbar Secures $1.5 Million in Funding

3.8 Egypt’s DentaCarts Raises $450,000 in Seed Funding Investors

3.9 Morocco Allows Imports of Russian Beef to its Market

3.10 American Airlines Launches ‘Codeshare Deal’ with Royal Air Maroc

4: CLEAN TECH & ENVIRONMENTAL DEVELOPMENTS

4.1 New Dubai Vertical Farm Set to Start Operations in Second Quarter of 2020

4.2 Giant Solar Park in the Desert Jump Starts Egypt’s Renewables Push

5: ARAB STATE DEVELOPMENTS

5.1 Lebanon’s Trade Deficit Reaches $12.49 Billion in 2019’s Third Quarter

5.2 Number of Tourists to Lebanon Shrank by 14.2% to 142,624 in October 2019

5.3 Number of Lebanese Construction Permits Slumps by 19.37% in November 2019

5.4 Jordan’s Trade Balance Deficit Drops by 14% in 10 months

5.5 Jordan & USAID Sign $745 Million Grant Agreement

♦♦Arabian Gulf

5.6 Saudi Arabia & Kuwait to Sign Deal to Restart Production at Oilfields

5.7 Qatar Budget Surplus to Shrink in 2020

5.8 UAE Leaders Reveal Plan to Develop Strategy for Next 50 Years

5.9 USA, UK and France Top List of Visitors to Dubai in Third Quarter

5.10 UAE Tax Revenues Exceed $6.8 Billion, 5.5% of Public Purse

5.11 UAE’s Khalifa Port to Get a $1 Billion Upgrade

5.12 Overseas Tourism Worth Nearly $28 Billion to Dubai

5.13 Expo 2020 Forecast to Continue to Drive Dubai Construction Growth

5.14 Saudi Unemployment Drops to Lowest in Three Years

5.15 Saudi Arabia May Tap International Debt Markets to Fill Budget Gap

♦♦North Africa

5.16 Remittances to Egypt Reach $6.7 Billion in First Quarter of FY 2019/20

5.17 Egypt’s Economy to Strengthen in 2020 With 15% Rise in Profit Growth Rate

5.18 Egypt’s Trade Deficit Narrows by 28.7% in September

5.19 Egypt Signs $466.3 Million Locomotive Deal with Progress Rail

5.20 Egypt & USAID Sign a Second Phase of North Sinai Development Initiative Agreement

5.21 World Bank Loans Morocco $275 Million for Disaster Management Program

6: TURKISH, CYPRIOT & GREEK DEVELOPMENTS

6.1 Turkey Posts $7.6 Billion Trade Surplus with the EU Over First 10 Months of 2019

6.2 Turkey’s Unemployment Rate Falls to 13.8%

6.3 Tourist Arrivals in Cyprus at Record High in November and for the First 11 Months of 2019

6.4 Greece’s Current Account Deficit Shrinks in October

7: GENERAL NEWS AND INTEREST

*ISRAEL:

7.1 Jerusalem Ranked as World’s Fastest Growing Tourist Destination

*REGIONAL:

7.2 Lebanon PM-Designate Begins Tough Talks to Form Government7.3 Jordan & USA Sign MoU on Cultural Heritage and Antiquities Protection

7.4 Kuwait Appoints First Female Finance Minister in Arabian Gulf

7.5 Turkey Spent TL 214.6 Billion on Education in 2018

7.6 UN Studying Greek Demands for Action Against Turkey – Libya Deal

8: ISRAEL LIFE SCIENCE NEWS

8.1 Vocalis Health Closes Merger and a $9 Million Investment Round

8.2 CathWorks FFRangio System Receives Regulatory Approval in Japan

8.3 Else Nutrition Receives Favorable Regulatory Assessment Ahead of U.S. Market Launch

8.4 RSIP Vision Launches AI-Based Total Hip Replacement Solution

8.5 NovaSight Leverages Netflix and Disney to Cure Vision Disorders

8.6 CardiaCare Wins First Prize at Cardiovascular Interventions (ICI) Technology Parade

8.7 Medasense to Provide Pain Index Solution for Treatment of Dementia Patients

8.8 Metabomed Raises $12.5 Million to Advance its Lead Program into Clinical Studies

8.9 Raziel Therapeutics Raises $22 Million in Series C Funding Round

8.10 Zebra Medical & DePuy Synthes Deploy Cloud Based AI Orthopedic Surgical Planning Tools

8.11 Check-Cap Announces $4.75 Million Private Placement

8.12 OurCrowd, Perrigo & BOL Win the Government Tender for Medical Cannabis Incubator

9: ISRAEL PRODUCT & TECHNOLOGY NEWS

9.1 Sproutt Uses Data and AI to Finally Reward Life Insurance Customers Who Live Healthy

9.2 Lightbits Labs Launches Industry’s First NVMe/TCP Clustered Storage Solution

9.3 Panorays & Konfidas Collaboration to Provide Supply Chain Cyber Risk Management

9.4 Silverfort Recognized as a Microsoft Security 20/20 Partner Awards Finalist

9.5 Cubed Mobile Named a 2019 Gartner Cool Vendor

9.6 Wi-Charge PowerPuck, an Ultra-Compact Long-Range Wireless Charger

9.7 Tactile Mobility & HERE Technologies Partner to Increase Access to Tactile Data

9.8 SafeRide & NXP Advanced Vehicle Health Monitoring With AI-based Anomaly Detection

9.9 Chicony & Emza’s First Battery-Powered, AI-based Human Sensing Solution for IoT

9.10 Radiflow Wins 451 Firestarter Award for Its OT MSSP Partner Program

10: ISRAEL ECONOMIC STATISTICS

10.1 Israel’s Inflation Rate for November Fell by 0.4%

10.2 Composite State of the Economy Index for November 2019 Rises by 0.2%

10.3 Immigration to Israel Surging and Asylum Seekers No Longer Arriving

11: IN DEPTH

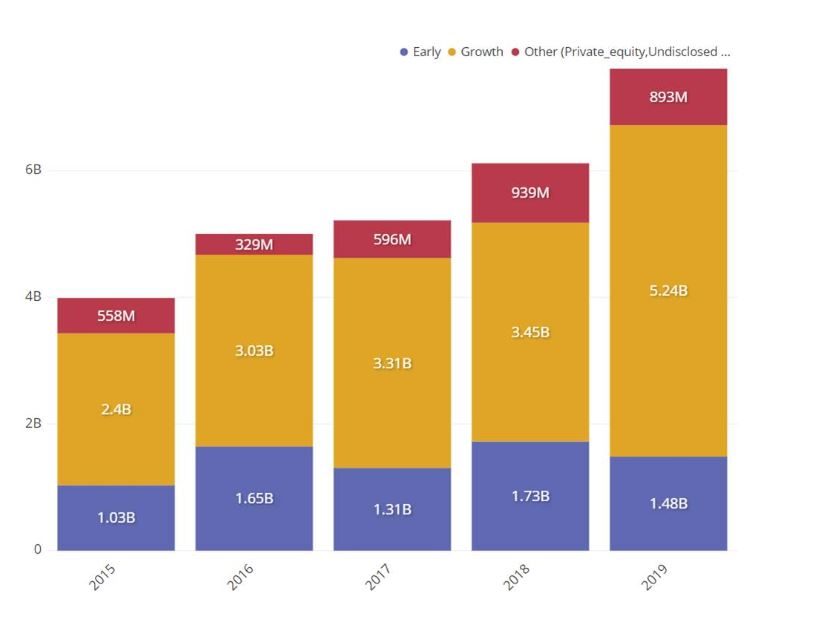

11.1 ISRAEL: Notable Increase in Late-Stage Funding Allows More Israeli Firms To Grow

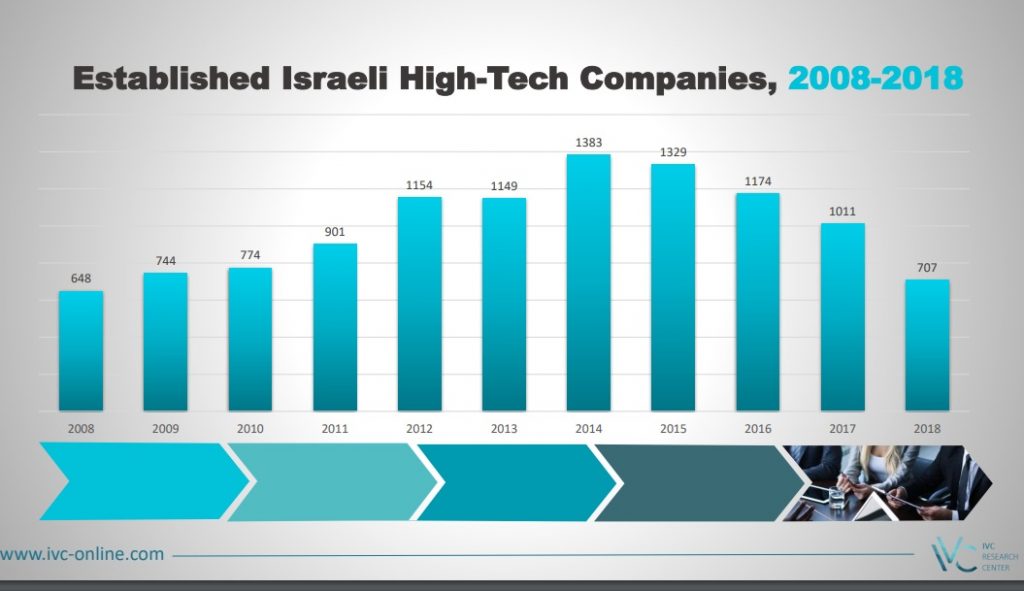

11.2 ISRAEL: Israel Exits Double in Value in 2019

11.3 ISRAEL: Israel’s International Investment Position (IIP), Third Quarter of 2019

11.4 LEBANON: Lebanon’s Free Fall

11.5 LEBANON: Lebanon Defense Market Report 2019

11.6 KUWAIT: Fitch Says Kuwait Political Mess Likely to Weigh on Economic Reforms

11.7 MOROCCO: IMF Completes the Second Review Under Liquidity Line Arrangement

11.8 TURKEY: The Perils of the Turkey-Libya Maritime Delimitation Deal

11.9 TURKEY: Erdoğan under Political Siege

11.10 TURKEY: Turkey’s Energy Miscalculations Have Hefty Cost

1: ISRAEL GOVERNMENT ACTIONS & STATEMENTS

1.1 Israel to Establish $4 Million Innovation Lab in Haifa for Environmental Tech

Israel is setting up a $4 million cleantech innovation lab focused on environmental protection and sustainability. The Ministries of Environmental Protection (MoEP), and Economy and Industry, together with the Israel Innovation Authority – which are co-leading the project – announced that ESIL Technologies, a group made up of Israeli and international companies, was selected to run the lab.

ESIL is a partnership between Bnnovation, an innovation platform of Israel’s oil refining company Bazan Group, EDF Renewables, a subsidiary of Electricité de France, and British chemical company Johnson Matthey. The lab, which will be located in Haifa, aims to transform Israel into an environmental tech powerhouse and strengthen the Israeli industry. It will also encourage Israeli startups in the field and help them develop and integrate into the global market.

ESIL will receive funding for three years to set up the lab with unique technological infrastructure. It will also receive the funds for the lab’s ongoing operation as well as any feasibility projects by companies whose projects are accepted by the lab. Projects that are accepted into their innovation lab can receive financial support for up to 85% of the budget, up to a ceiling of almost $286,000, for a period of up to one year. The projects will be in the field of environmental protection and sustainability, with an emphasis on the development of innovative technologies that are not based on fossil fuel sources. (MEP 15.12)

1.2 Israel, Cyprus & Greece to Sign Landmark Gas Pipeline Deal on 2 January

The leaders of Cyprus, Greece, and Israel plan to sign an agreement on 2 January for the building of the eastern Mediterranean natural gas pipeline. The agreement will be signed in Athens by Greek Prime Minister Mitsotakis, Cypriot President Anastasiades and Israeli Prime Minister Netanyahu.

As currently planned, the pipeline will run across the Mediterranean from Israel’s Levantine Basin offshore gas reserves to the Greek island of Crete and the Greek mainland, and then to Italy. The deal will be finalized with Italy’s signature at a subsequent date. In May, Italian Prime Minister Conte had expressed opposition to the Poseidon project, which is the last section of the pipeline that would connect Greece with Italy. Cyprus, Greece, and Israel already signed an agreement on the 1,900-kilometer (1,200-mile) pipeline earlier this year in the presence of US Secretary of State Pompeo.

The EastMed pipeline is expected to satisfy about 10% of the European Union’s natural gas needs, decreasing energy dependence on Russia. The EU has contributed to the cost of technical studies for the project. The three signatory countries are joined in a common opposition to Turkey’s recent deal with the UN-recognized Libyan government delineating “maritime borders” between the two countries in the Mediterranean. Turkey and Libya are geographically far from each other, with Greece and Egypt being in the way. (Various 23.12)

1.3 Israel Approves Gas Exports to Egypt

Israel has approved the export of gas from its offshore reserves to Egypt, with a major reservoir expected to begin operations very soon. The 16 December approval by Energy Minister Steinitz was part of a long process under which Israel will transform from an importer of natural gas from Egypt into an exporter and potential regional energy player. It will be the first time Egypt, which in 1979 became the first Arab country to sign a peace accord with Israel, imports gas from its neighbor.

US-based Noble and Israel’s Delek, the consortium leading the development of the two offshore reservoirs, reached a $15 billion, 10 year deal last year with Egypt’s Dolphinus to supply 64 billion cubic meters (2.26 trillion cubic feet). Israel had previously bought gas from Egypt, but land sections of the pipeline were targeted multiple times by Sinai based Islamic terrorists in 2011 and 2012.

Tamar, which began production in 2013, has estimated reserves of up to 238 billion cubic meters (8.4 trillion cubic feet). Jordan began purchasing gas from Tamar on a small scale nearly three years ago. Leviathan, discovered in 2010, is estimated to hold 535 billion cubic meters (18.9 trillion cubic feet) of natural gas, along with 34.1 million barrels of condensate. Leviathan is expected to be operational shortly, with exports to Egypt set to begin on 1 January.

Besides being energy independent, Israel hopes its gas reserves will enable it to strengthen strategic ties in the region and help forge new ones, with an eye on the European market. Natural gas is set to replace coal as the fuel generating electricity in Israel’s power plants. (AFP 17.12)

1.4 Israel’s National Infrastructure Committee Approves Construction of 6th Desalination Plant

Seeking to fight the surging water crisis, Israel’s National Infrastructure Committee has approved the construction of another desalination plant, this time in the Western Galilee. The new facility will join an array of five desalination plants that already operate on the country’s Mediterranean coast. The Western Galilee was chosen to house the plant because the area has been plagued by a prolonged drought and its access to desalinated water from the other facilities is limited over topographical issues that restrict pumping water to it.

Construction plans for the new facility detail two stages, with 100 million cubic meters of water being produced in each stage. This would make the new facility the largest in Israel and one of the largest in the world to use reverse osmosis technology.

Earlier this year, the Finance Ministry issued tenders for the plant’s construction. Bids were received from Israel’s IDE Technology, Hutchison Water, whose main investor is Hong Kong’s CK Hutchison Holdings, and a partnership of Afcon, Acciona and Allied Investments. The European Investment Bank has already said it would provide up to €150 million ($167 million) to help finance the project. (Various 19.12)

1.5 Top Officials of 11 U.S. States Visiting Israel with AJC Project Interchange

A bipartisan delegation of Secretaries of State from across the United States visited Israel with the American Jewish Committee’s (AJC) Project Interchange. The program features in-depth discussions on cybersecurity policies and practices at the state, local, and federal level as it relates to business services, election administration, and records management. The weeklong educational seminar further aimed to enhance US – Israel relations at the vital state level. A number of American states have been expanding commercial and other ties with Israel. The 11-member delegation is chaired by Paul Pate of Iowa, President of the National Association of Secretaries of State (NASS) and Iowa Secretary of State. This is the first NASS delegation to visit Israel in partnership with Project Interchange.

The seminar provided the state officials with a firsthand understanding of Israel and mutually-beneficial bilateral ties. During the visit, they will learn about Israel, its vibrant democracy, diverse population, regional challenges, and economic and technological innovation, and the shared values between the U.S. and Israel.

Delegation participants included: Alabama Secretary of State John Merrill, Alaska Lt. Governor Kevin Meyer, Iowa Secretary of State Paul Pate, Kansas Secretary of State Scott Schwab, Maine Secretary of State Matt Dunlap, Michigan Secretary of State Jocelyn Benson, Montana Secretary of State Corey Stapleton, Nevada Secretary of State Barbara Cegavske, New Jersey Secretary of State Tahesha Way, West Virginia Secretary of State Mac Warner and Wyoming Secretary of State Ed Buchanan.

For over 35 years, AJC Project Interchange (American Jewish Committee) has brought 6,000 influential figures to Israel from 110+ countries and all 50 U.S. states, offering broad exposure and first-hand understanding of the complex issues facing Israel and the region. (AJC 16.12)

1.6 Tel Aviv Imposing Stiff E-Scooter Restrictions as Injuries Mount

The Tel Aviv municipality has issued new instructions on e-scooters as the number of injuries from accidents mounts. Tel Aviv will become the world’s first city to require all electric bicycles and e-scooters for hire to have license numbers and helmets. The city will also ban electric bikes and scooters from busy pedestrian areas such as Tel Aviv Port. The speed limit for electric scooters and bikes will be reduced from 25 kilometers per hour to 15 in certain areas. GPS devices attached to the scooters will slow them down where the limit has been reduced.

In the past month alone Globes found that 288 people came to the emergency and accidents room at Tel Aviv’s Ichilov Hospital following injuries involving electric scooters and bikes. There was one fatality and 15% of the injuries were to the head. There are an estimated 8,000 electric scooters for hire in Tel Aviv and many thousands more private scooters.

The new license plates, which will be attached by the start of January, will enable people to report violations to the municipality, such as riding on the sidewalk, and the scooter companies will be required to sanction whoever had leased the scooter at the time – three violations and the scooter company will be required to block the users account. (Globes 17.12)

2: ISRAEL MARKET & BUSINESS NEWS

2.1 Scope AR Acquires Augmented Reality Toolset Company WakingApp

San Francisco’s Scope AR, the pioneer of enterprise-class augmented reality (AR) solutions, announced its acquisition of WakingApp, an AR technology company based in Tel Aviv, Israel. With this acquisition, six of the founding members of the WakingApp team will remain with the company and bring additional resources and expertise for developing the next generation of Scope AR’s augmented reality knowledge platform, WorkLink.

WakingApp has a proprietary AR platform with technologies to help enterprises across industries easily create cutting-edge AR experiences. The acquisition of WakingApp by Scope AR expands the company’s resources to more rapidly deliver new functionality to its WorkLink solution and push the boundaries of what’s possible in enterprise AR as the market continues to mature. WorkLink is the industry’s only industrial AR knowledge platform to provide real-time remote assistance and access to pre-built AR work instructions simultaneously in one application to allow workers to easily access the knowledge they need. (Scope AR 11.12)

2.2 WeBuy Partners With ExitValley to Launch Their Equity Funding Round

WeBuy is now beta testing their innovative mobile shopping platform. The pilot release, scheduled for January 2020 in Oxford, is sure to make big waves in the online shopping industry. With WeBuy, buyers and sellers can connect to each other more directly, allowing buyers to find the goods and services they are looking for without the hassle of going store to store to find the best deal.

In December 2019, WeBuy launched a fundraising campaign on ExitValley. WeBuy works to be valuable for both consumers and businesses. As such, they aim to involve the general public in this first round of fundraising. WeBuy aims to make online shopping more efficient for both consumers and sellers by matching sellers with consumers directly. Currently, consumers have to go from store to store, or website to website, searching for the exact product or the best deal for the good or service they want to buy. With WeBuy, consumers post what they are looking for and sellers send them their best product and price. Then, the consumer can choose from the options and find the best deal for them. This takes the stress out of shopping and makes the whole process easy and quick.

Tel Aviv’s WeBuy is the first on-demand shopping platform. It connects people and local businesses, on-demand and in real-time. WeBuy provides buyers and sellers with the tools that allow them to save money and time while making educated and targeted decisions. (WeBuy 11.12)

2.3 Stifel Opens Israel Office

St. Louis’ Stifel Financial Corp. announced the opening of its first office in Israel, focused on investment banking and related institutional services. Stifel is a premier full-service investment bank serving middle-market clients. According to Dealogic data, Stifel ranks No. 1 among middle market firms in public M&A transactions under $1 billion, No. 1 in equity deals under $1 billion in market capitalization and among the top three managers of venture capital-backed IPOs. Stifel is also a top-ranked U.S. equity research provider offering more coverage of small and midcap companies than any other firm.

Stifel Financial Corp. is a financial services holding company that conducts its banking, securities and financial services business through several wholly owned subsidiaries. Stifel’s broker-dealer clients are served in the United States through Stifel, Nicolaus & Company, including its Eaton Partners business division; Keefe, Bruyette & Woods, Miller Buckfire & Co., Century Securities Associates and in the United Kingdom and Europe through Stifel Nicolaus Europe Limited. (Stifel 10.12)

2.4 Intel Acquires Artificial Intelligence Chipmaker Habana Labs

On 16 December, Intel Corporation announced that it has acquired Tel Aviv’s Habana Labs, an Israel-based developer of programmable deep learning accelerators for the data center for approximately $2 billion. The combination strengthens Intel’s artificial intelligence (AI) portfolio and accelerates its efforts in the nascent, fast-growing AI silicon market, which Intel expects to be greater than $25 billion by 2024.

Habana will remain an independent business unit and will continue to be led by its current management team. Habana will report to Intel’s Data Platforms Group, home to Intel’s broad portfolio of data center class AI technologies. This combination gives Habana access to Intel AI capabilities, including significant resources built over the last three years with deep expertise in AI software, algorithms and research that will help Habana scale and accelerate.

Additionally, Habana’s Goya AI Inference Processor, which is commercially available, has demonstrated excellent inference performance including throughput and real-time latency in a highly competitive power envelope. Gaudi for training and Goya for inference offer a rich, easy-to-program development environment to help customers deploy and differentiate their solutions as AI workloads continue to evolve with growing demands on compute, memory and connectivity. (Intel 16.12)

2.5 Satori Cyber Raises $5.25 Million to Deliver Industry’s First Secure Data Access Cloud

Satori Cyber announced it received $5.25 million in seed funding led by YL Ventures. Satori Cyber’s mission is to help organizations maximize their data-driven competitive advantage by removing barriers to broad data access and usage while ensuring security, privacy and compliance. The Satori Cyber Secure Data Access Cloud is the first solution on the market to offer continuous visibility and granular control for data flows across all cloud and hybrid data stores. The Satori Cyber Secure Data Access Cloud is currently in limited availability to qualified customers. General availability will begin in Q3/20.

Tel Aviv’s Satori Cyber is revolutionizing data protection and governance. Its Secure Data Access Cloud seamlessly integrates into any environment to deliver complete data-flow visibility utilizing activity-based discovery and classification. The platform provides context-aware and granular data access and privacy policies across all enterprise cloud or hybrid data stores. With Satori Cyber, organizations and their security teams can confidently ensure that data security, privacy and compliance are in place, enabling data-driven innovation and competitive advantage. (Satori Cyber 17.12)

2.6 Arbe Raises $32 Million for High-Definition Radar Chipset for ADAS & Autonomous Vehicles

Arbe announced the closing of $32 million in Round B funding from existing, new, and CVC investors Catalyst CEL, BAIC Capital, AI Alliance (Hyundai, Hanwha, SKT), and MissionBlue Capital, and from earlier investors Canaan Partners Israel, iAngels, 360 Capital Partners, O.G. Tech Ventures, and OurCrowd. Arbe will use the funding to move to full production of its breakthrough radar chipset, which generates an image 100 times more detailed than any other solution on the market today.

With the new funding, Arbe will focus on expanding its team to support global Tier-1 customers in moving into full production of radar systems based on Arbe’s radar development platform. The delivery of radars based on Arbe’s proprietary chipset is a game changer in the automotive industry, as Arbe’s technology is the first to enable highly precise sensing in all environment conditions. The unique radar technology produces detailed images; separates, identifies and tracks hundreds of objects in high horizontal and vertical resolution to a long range in a wide field of view; enabling the OEMs to provide all-conditions, uncompromised safety to next generation cars with an affordable sensor for mass market implementation.

Tel Aviv’s Arbe is a provider of next-generation 4D Imaging Radar Chipset Solution, enabling high-resolution sensing for ADAS and autonomous vehicles. Arbe’s technology produces detailed images, separates, identifies, and tracks objects in high resolution in both azimuth and elevation in a long range and a wide field of view, and complemented by AI-based post-processing and SLAM (simultaneous localization and mapping). Arbe’s patented technology empowers automakers and Tier 1 companies in development of a next-generation radar that is 100 times more detailed than any other radar on the market, capable of operating in any weather or lighting environment. (Arbe Robotics 16.12)

2.7 E-Scooter Firm Lime Issues Call For Safety Innovation Proposals from Israeli Startups

Micro-mobility company Lime has launched a safety portal in Hebrew for its Tel Aviv-based users, offering safety and parking tips, insurance and other information, instructions on where to purchase discounted helmets, and details on upcoming meetings and gatherings for Lime riders. The company also issued a call for safety innovation proposals from local startups, amid a crackdown by the Tel Aviv Municipality on scooter riders across the city and tougher restrictions on scooter companies.

The regulations include limiting the number of scooters and e-bikes available per provider and requiring the companies to hand over information to the municipality for research and analysis. The companies are also required to provide their services through the city, which has designated areas for riding and parking.

Tel Aviv recently issued stiffer restrictions, requiring shared scooters and e-bikes to have license plates and helmets. This will make Tel Aviv the first city in the world to have this requirement. The speed limit will also be reduced from 25km/h to 15km/h. Scooters and bikes are already banned from sidewalks, with riders facing fines for endangering pedestrians, not wearing helmets and being on the phones. The crackdown followed a number of severe injuries and even deaths involving shared scooters and bikes, and complaints by residents feeling endangered on sidewalks.

Tel Aviv introduced shared scooters almost two years ago and a number of international providers operate in the city including Lime, Bird and Wind. Tel Aviv has quickly become one of Lime’s top-performing markets. Lime also put out a call for proposals from Israeli startups “to help promote innovative safety advancements through new, locally sourced technology.” Intelligent Transport reported that Lime will fund the implementation of selected initiatives. (NoCamels 17.12)

2.8 Tel Aviv Stock Exchange Seeks To Improve Transparency & Broaden Appeal

On 17 December, the Tel Aviv Stock Exchange (TASE) announced it is considering a new plan to try to enhance liquidity and improve transparency to try to attract more ordinary investors. The plan would impose restrictions on off-exchange transactions and provide an incentive program for market-making in shares in the Tel Aviv 35 index, TA35, similar to those available in leading exchanges worldwide. The TASE, which went public in August, has lost 40% of investors since 2010. With 447 traded companies at a market value of $215 billion, the exchange has been struggling with de-listings and declining trading volumes.

In 2019, nearly 23% of the total volume of securities trading on TASE derived from transactions entered into off the exchange – some 80,000 a year, averaging NIS 800,000 ($230,000) per transaction. Reporting off-exchange transactions is not mandatory in Israel and they may be entered into at any agreed price and volume. TASE is considering imposing a real-time reporting obligation on all transactions and permitting such transactions only for securities defined as “illiquid.”

TASE is also considering improving liquidity by encouraging market-making in major shares through incentives to stock exchange members that meet certain criteria. The program would be assessed over the course of a year. To date, there is virtually no market-making in major shares in Israel. Exchanges such as Euronext, the Frankfurt Stock Exchange, the Swiss Stock Exchange, the Korean Stock Exchange, and more operate incentive programs for market-makers. The programs are based on payments or refund of fees to market-makers, who make it easier for traders and investors to buy and sell. (Israel Hayom 18.12)

2.9 Gloat Secures $25 Million in Series B Funding from Eight Roads and Intel Capital

Gloat has raised $25 million in Series B funding to further its mission of democratizing career development, unlocking skills, and enabling enterprises to build a future-proof workforce. The round was led by Eight Roads Ventures, the proprietary investment firm backed by Fidelity, alongside Intel Capital. Existing investors Magma Venture Partners and PICO Partners also participated. The funds will be used to expand Gloat’s New York and Tel Aviv offices with an ambitious hiring plan, and further enhance its HR technology, which has already been implemented by some of the world’s largest employers including Unilever and Schneider Electric.

Gloat’s AI-powered internal talent marketplace provides full visibility on an individual’s unique career path, by analyzing different possible career options and following the achievements and aspirations of an employee from their first day at the company. It then proactively matches employees with internal part-time projects, gigs, full-time positions, mentorships and job swaps so they can grow and gain targeted new skills, while also expanding their network. Previously, career progress was limited to the well-networked and privileged, now career growth is being democratized as a user-friendly platform and mobile application. Gloat also enables enterprises to gain real-time insights into their internal talent pools and impending skills gaps, providing managers with the frictionless access to the skills they need without the need for costly external recruitment.

Founded in 2015, Gloat is redefining the future of work with its mission to democratize career development, unlock skills, and help enterprises build a future-proof workforce. The company is based in New York and has a large R&D center in Tel Aviv, Israel. Gloat’s technology is being used by some of the largest employers in the world. (Gloat 18.12)

2.10 Atrinet – Lenovo Strategic Partnership to Accelerate Transition to Open Networking

Atrinet announced a strategic partnership with Lenovo. Atrinet’s solution enables Communications Services Providers (CSPs) to manage digital network transformation using NetACE™. This partnership accelerates Atrinet’s market penetration to CSPs, data centers and enterprises. The Atrinet-Lenovo partnership expands CSPs’ deployment of open network infrastructure.

Atrinet’s NetACE network and service software for discovery and automation takes digital transformation agility to a whole new level. It simplifies processes with self-service onboarding of new vendors, technologies, and services. NetACE is vendor-agnostic, enabling smart and automatic migration to virtual networks. NetACE is an open model-driven network management platform that allows for real-time, policy-based provisioning and discovery of multi-vendor SDN/NFV and legacy networks.

Hod HaSharon’s Atrinet is an Independent Software Vendor (ISV) of elastic network and service management solutions for hybrid legacy, Network Function Virtualization and Software-Defined networks for accelerating services delivery and empower network operations. Atrinet’s solutions have been deployed by the largest service providers and enterprises driving unrivaled multi-vendor service agility and speed through an innovative model-based customization approach. (Atrinet 18.12)

2.11 BIRD Energy to Invest $6.4 Million in Cooperative Israel-U.S. Clean Energy Projects

The U.S. Department of Energy (DOE) and Israel’s Ministry of Energy (MoE) along with the Israel Innovation Authority have selected seven clean energy projects to receive $6.4 million under the Binational Industrial Research and Development (BIRD) Energy program. The total value of the projects is $15.4 million, which includes $9 million of cost share from the companies selected for funding. BIRD Energy began in 2009 as a result of the Energy Independence and Security Act of 2007. Each project is conducted by a U.S. and an Israeli partner. Selected projects address energy challenges and opportunities that are of interest to both countries and focus on commercializing clean energy technologies that improve economic competitiveness, create jobs and support innovative companies. The seven approved projects are:

Projects that qualify for BIRD Energy funding must include one U.S. and one Israeli company, or a company from one of the countries paired with a university or research institution from the other. The partners must present a project that involves innovation in the area of energy and is of mutual interest to both countries. BIRD Energy has a rigorous review process and selects the most technologically meritorious projects along with those that are most likely to commercialize and bring about significant impact. Qualified projects must contribute at least 50% to project costs and commit to repayments if the project leads to commercial success.

The BIRD (Binational Industrial Research and Development) Foundation encourages and facilitates cooperation between U.S. and Israeli companies in a wide range of technology sectors and offers funding to selected projects. The BIRD Foundation supports projects without receiving any equity or intellectual property rights in the participating companies or in the projects, themselves. BIRD funding is repaid as royalties from sales of products that were commercialized as a result of BIRD support. (BIRD 23.12)

2.12 MusashiAI Launches World’s First Robot Employment Agency

MusashiAI, a joint venture between SixAI of Israel and Musashi Seimitsu of Japan (a Honda Motor Corporation affiliate company), has launched its fully-autonomous robots to integrate seamlessly with human workers in an industry 4.0 factory environment. Its robots will undertake the often strenuous and repetitive work endured by humans in industrial workplaces. Both of its forklift and visual inspection AI-controlled robots are being tested by Musashi Seimitsu, a global leader in automotive transmission parts with 35 manufacturing plants worldwide. The JV also introduces a unique business model by providing industrial employers an option to source needed labor through a robotic employment agency, instead of investing significant capital in purchasing robots. The model allows companies to hire robot labor by the hour or pay a task-completed-based salary rate.

These developments represent a major leap forward in the deployment of robots. The robots are genuinely autonomous, opposed to automated – they are given tasks and define their own optimal way to perform them, just as humans do. The new commercial model of hiring robots by the hour or task means that they are now available to support many more companies or organizations. Self-taught machine learning is central to this achievement. (MusashiAI 23.12)

2.13 OTI Raises $2.5 Million from Investors

On Track Innovations (OTI) announced that on 23 December 2019 it entered into a share purchase agreement with Jerry L. Ivy, Jr. Descendants’ Trust (“Ivy”) and two other investors who are members of the Company’s Board of Directors. The Agreement relates to a private placement of an aggregate of up to 12,500,000 ordinary shares of the Company at a purchase price of $0.20 per share, for aggregate gross proceeds to the Company of up to $2,500,000. The initial closing of the private placement took place on 23 December. At the initial closing, 6,500,000 shares were issued for aggregate gross proceeds to the Company of $1,300,000. A subsequent closing for the remainder of the amount to be invested is subject to the Company obtaining approval of its shareholders to, among other things, an increase the authorized share capital of the Company.

Rosh Pina’s On Track Innovations (OTI) is a global leader in the design, manufacture and sale of secure cashless payment solutions using contactless NFC technology. OTI’s field-proven innovations have been deployed around the world to address cashless payment and management requirements for automated retail and petroleum markets.

3:REGIONAL PRIVATE SECTOR NEWS

3.1HALO Maritime Opens Headquarters Office in Bahrain

Newton, New Hampshire’s HALO Maritime Defense Systems, a marine engineering technology company and provider of advanced engineered solutions for the security needs of strategic maritime assets, announced its choice of Bahrain for its Middle East headquarters for investment in business development and building local relationships. Global maritime security risks are persistent and pervasive, and HALO Maritime has an opportunity to rapidly expand its Middle East business portfolio by taking advantage of the superior business climate in Bahrain.

HALO is taking advantage of several benefits available to firms based in business-friendly Bahrain. Lower operating costs than other regional neighbors, a local workforce with an array of valuable skills, and its position as a natural gateway to the entire region, all make Bahrain an attractive headquarters location.

HALO Maritime Defense Systems (HALO) offers unique maritime sea barrier solutions to secure critical assets vulnerable to water-based attacks. In a security-conscious world, both government assets (Naval bases, ships and facilities) and commercial and private assets (ports, terminals, nuclear power plants, and oil & gas rigs) have a real, immediate, and critical need for high levels of protection. HALO’s NEXT GENERATION patented maritime security products offer unique solutions to difficult marine security scenarios. HALO has the only maritime barrier to have been independently tested to meet U.S. Navy requirements. (HALO 15.12)

3.2 Inventus Power Establishes Manufacturing Operations in Qatar Free Zones

Woodridge, Illinois’ Inventus Power announced it will establish a manufacturing presence in Qatar Free Zones and has entered into a partnership with Qatar Free Zones Authority (QFZA) to accelerate international expansion. Inventus is a global leader in the design and manufacture of Li-ion battery packs, chargers and power supplies for the commercial, industrial, consumer, medical and military markets across a broad range of portable, motive and stationary applications. The QFZA partnership will include a minority investment into Inventus to further facilitate growth and the entrance into new markets. Terms were not disclosed.

In addition to establishing a manufacturing presence in Qatar, Inventus also plans to invest in additional research and development capabilities through partnerships with the impressive roster of universities and research institutions already located in the country, including through a significant local research hub.

Inventus Power, founded in 1960, is the leading provider of advanced battery systems for global OEMs. We specialize in the design and manufacture of battery packs, chargers, and power supplies across a broad range of portable, motive & stationary applications. (Inventus Power 20.12)

3.3 Emirates Healthcare Development Company Raises $150 Million to Fund Centers of Excellence

A group of regional banks, including Emirates Islamic and Emirates NBD Capital, the investment banking arm of Emirates NBD, announced the close of an AED550 million ($150 million) syndicated financing facility for Emirates Healthcare Development Company, the owner of Saudi German Hospital, Dubai. The participating banks also included Gulf International Bank, Mashreq Bank, Commercial Bank of Dubai, Ahli United Bank, National Bank of Fujairah, National Bank of Kuwait, Arab African International Bank and United Arab Bank. The syndication was three times oversubscribed.

Since opening its first hospital in Dubai in 2012, the Saudi German Hospital Group has continued to expand its presence in the UAE. It now has hospitals in Sharjah and Ajman and is building centers of excellence, for which it is using part of this facility. (AB 20.12)

3.4 Floranow Closes $3 Million Series A Round Led by Wamda and Global Ventures

Dubai’s Floranow, the business-to-business (B2B) online floral marketplace, has closed a $3 million Series A round, co-led by Wamda and Global Ventures. The round includes previous investors Dash Ventures, Jabbar Internet Group, as well as new investors Sirocco Holdings, Adamtech Ventures, Zuaiter Holding Capital, HB Investments and angel investors.

This latest round of funding will be used to support Floranow’s growth in Kuwait and further its expansion into the GCC, starting with Saudi Arabia. The company will also focus on optimizing its proprietary marketplace technology. Through its platform, Floranow disintermediates the marketplace for horticultural produce and minimizes the variability in demand for florists, effectively bypassing multiple layers of a costly, and at times, inefficient supply chain.

Founded in 2016, Floranow connects horticulturists and suppliers from across the globe, including Colombia and Holland, directly to flower retailers through its online B2B marketplace. The company had previously raised its first round of financing from Jabbar Internet Group, Dash Ventures and Wamda back in December 2017. (MAGNiTT 15.12)

3.5 VentureSouq Invests in Insurance Platform Vouch

Dubai-based VentureSouq (VSQ) has invested in San Francisco, California’s Vouch, an insurance platform exclusively targeting startups. Vouch announced its Series B of $45 million led by Y Combinator’s Continuity Fund. Previous top-tier investors include Ribbit Capital, SVB Financial Group, Y Combinator, Index Ventures and 500 Startups. The platform offers fast, tailored, digitally-delivered insurance designed to support and scale with startups in high-pressure, rapid-growth environments. (VentureSouq 15.12)

3.6 Carzaty Launches in UAE with $4 Million in Funding

Carzaty, an online retailer for new and assured used cars, is launching in the United Arab Emirates. The rapidly growing e-commerce startup taps into the latest technology to offer a more affordable and convenient way to buy cars. Founded in 2017, Carzaty has raised $4 million in funding to date, and most recently announced a strategic investment from Innovation Development Oman (IDO Investments) to accelerate the company’s growth plans in the region. Carzaty replaces the large, expensive showroom with a simple and transparent digital experience, eliminating huge overhead costs. This innovative retail model enables Carzaty to sell cars for prices up to 25% less than traditional dealers.

Carzaty was founded in Muscat, Oman in 2017. In addition to IDO Investments, Carzaty’s shareholders include venture capital firms and strategic investors with roots in the automotive industry. (Carzaty 17.12)

3.7 Sabbar Secures $1.5 Million in Funding

Riyadh’s Sabbar, a Saudi-based tech startup that aims to be the platform of choice for connecting job seekers with businesses for on-demand work opportunities in the region, has raised $1.5 million in funding. The seed round was led by Dubai-based Venture Souq, backed by 500 Startups, Derayah VC and Super Angels from Saudi Arabia. The company stated that it is planning to use the money for engineering and operations teams to further develop the platform for gig jobs including enhancing its matching algorithm, operations automation, and scheduling management.

In Saudi Arabia, employee turnover is estimated at 70% in the retail and service industries, placing thousands of businesses at financial risk. In addition, the region has a significant unutilized workforce of students. Sabbar aims to bridge this gap by leveraging technology to provide businesses the opportunity to fulfill shift on-demand with temporary workers. Additionally, the platform relieves businesses from associated administrative costs by streamlining a lengthy process that typically includes interviews, training, placement, shift scheduling, worker payments, and everything in-between.

Sabbar enables businesses in retail, entertainment and hospitality industries to book casual staff during peak hours or high seasons from a roster of pre-qualified professionals. Since its launch in mid-2019, Sabbar has received over 100,000 job applications and is currently connecting hundreds of workers to businesses on a monthly basis. Sabbar leverages a proprietary engine, which builds user & role profiles and leverages geospatial analytics to match workers with job opportunities near them, in roles which to date have included cashiers, baristas, sales associates, among others. (Sabbar 15.12)

3.8 Egypt’s DentaCarts Raises $450,000 in Seed Funding

Nasr City’s DentaCarts is a one-stop-shop marketplace for dental supplies that offers the widest range of authenticated products via authorized dealers. Moreover, DentaCarts is deeply integrated with dental clinics management software, creating a higher quality marketplace through deep data insights and analytics. DentaCarts is the largest of its kind not only in Egypt but also in the Middle East.

Having been part of Misk500‘s first cohort, DentaCarts was co-founded in late 2017. The company has successfully raised an investment of $450,000 from 500 Startups (US), AAIC (Japan), Wadi Makkah (Saudi Arabia) and AUC Angels (Egypt). This unique marketplace is dealing with three main issues, the fake products that have serious complications to patients’ health and safety, limited access to the market then limited choices, and over-inflated prices. The company claims that so far, they have served over 1,500 dental clinics, and delivered over 10,000 orders to Egypt, Saudi Arabia, Kuwait, Kenya and Ghana. DentaCarts consists of a variety of more than 10,000 items on its platform, from monthly supplies to clinic furnishing, and it has over 100 authorized dealers onboard. (DentaCarts 22.12)

3.9 Morocco Allows Imports of Russian Beef to its Market

Rabat and Moscow have concluded an agreement that will allow Russian companies to export beef to the Moroccan market. The Federal Service for Veterinary and Phytosanitary Surveillance announced that the two countries signed a veterinary certificate to supply Morocco with beef products. The veterinary office emphasized that Russian companies have already passed the inspection of Morocco’s veterinary service. The export of Russian meat will start immediately.

Both Moscow and Rabat vowed to strengthen agricultural cooperation at their 7th session of the Moroccan-Russian Joint Cooperation Committee last year. Agricultural products represent 77% of Moroccan exports to Russia. The products value is estimated at MAD 1.5 billion. Russia is also Morocco’s primary citrus export destination. The minister said that citrus fruits top agricultural exports, followed by other fruits and vegetables. In 2017-2018, the North African country’s exports of mandarin and tangerine totaled 205,091 metric tons to Russia and 166,299 metric tons to the EU. Since 2014, trade has grown between the two countries by 10%. Last year, trade between Russia and Morocco increased in the first half of 2018 to $900 million, or 20% more than the same period of 2017. To boost agricultural cooperation, Morocco also lowered the grain tax to zero for Russia.

Last year, the US Trade Representative (USTR) and the US Department of Agriculture (USDA) announced that Morocco agreed to allow imports of US beef and beef products into Morocco. Moroccan imports of agricultural products from the US exceeded $512 million as of November last year, according to the USDA. The US forecasts that Morocco would represent an $80 million market for US beef and beef products. Morocco also agreed to authorize US poultry imports last year. (MWN 19.12)

3.10 American Airlines Launches ‘Codeshare Deal’ with Royal Air Maroc

American Airlines announced the launch of a codeshare agreement with Morocco’s state owned carrier Royal Air Maroc (RAM). The agreement will be effective from 26 December, whereby the two airlines will jointly offer new options to travel to Morocco. Customers of American Airlines will be able to buy tickets for RAM flights to Casablanca. The codeshare will expand to other cities across Africa in 2020. Casablanca’s international airport is a well situated hub to offer American Airlines’ customers “convenient connections between North America and over 40 destinations throughout Africa. The airline aims to increase visibility in the African market through the codeshare agreement with Morocco’s RAM. (MWN 22.12)

4: CLEAN TECH & ENVIRONMENTAL DEVELOPMENTS

4.1 New Dubai Vertical Farm Set to Start Operations in Second Quarter of 2020

Dubai Industrial City has announced it will be home to Badia Farms’ upcoming new large-scale high-tech vertical farm. Badia Farms, a regional AgTech leader, said the vertical farm is expected to start operations in the second quarter of 2020. Spanning an area of 50,000 sq. ft., the facility will have the capacity to produce 3,500kg of high-quality fruits and vegetables on a daily basis.

From Dubai Industrial City, Badia Farms will grow more than 30 varieties of fruits and vegetables sustainably. The Badia Farms facility in Dubai Industrial City is rare as it will combine fruits and vegetables on a commercial large-scale basis. Vertical farming uses high-tech methods to produce crops in a controlled environment leveraging vertical space, without pesticides, and using fewer resources compared to traditional farming. (AB 17.12)

4.2 Giant Solar Park in the Desert Jump Starts Egypt’s Renewables Push

Near the southern Egyptian city of Aswan, a swathe of photovoltaic solar panels spreads over an area of desert so large it is clearly visible from space. They are part of the Benban plant, one of the world’s largest solar parks following completion last month of a second phase of the estimated $2.1 billion project. Designed to anchor a renewable energy sector by attracting foreign and domestic private-sector developers and financial backers, the plant now provides nearly 1.5 GW to Egypt’s national grid and has brought down the price of solar energy at a time when the government is phasing out electricity subsidies.

In 2013, Egypt was suffering rolling blackouts due to power shortages at aging power stations. Three gigantic gas-powered stations with a capacity of 14.4 GW procured from Siemens in 2015 turned the deficit into a surplus. National installed electricity capacity is now around 50 GW and Egypt aims to increase the share of electricity provided by renewables from a fraction currently to 20% by 2022 and 42% by 2035.

The Benban project’s 32 plots were developed by more than 30 companies from 12 countries, including Spain’s Acciona, UAE-based Alcazar Energy, Italy’s Enerray, France’s Total Eren and EDF, China’s Chint Solar and Norway’s Scatec. Developers of the plant, around 40 km (25 miles) northwest of Aswan, are guaranteed a feed-in tariff price for 25 years. A third phase at Benban could add more than 300 MW, though nothing has been decided yet, while another large scale solar development is planned 45 km north of Aswan at Kom Ombo. (Reuters 17.12)

5: ARAB STATE DEVELOPMENTS

5.1 Lebanon’s Trade Deficit Reaches $12.49 Billion in 2019’s Third Quarter

Lebanon’s trade deficit narrowed in the first 9 months of the year to reach $12.49B, down by 3.58% compared to the same period in 2018. The total value of imports gained an annual 0.98% to stand at $15.30B. Also, the value of exports rose by 27.83% to stand at $2.81B in Q3/19. Worth noting that Mineral products and Vegetable products are the only 2 categories to witness an increase in its imported value. As for the month of September alone, total Deficit amounted to $1.12B which is 8.20 % lower when compared to the same month last year. In term of value, Mineral products were the leading imports to Lebanon in Q3 2019, grasping a 34.06% stake of total imported goods. Products of the chemical or allied industries followed, constituting 10.17% of the total, while machinery and electrical instruments grasped 8.71% of the total. Lebanon imported $5.21B worth of Mineral Products, compared to a value of 3.20B in the same period last year. The net weight of imported mineral fuels, oils and their products is still increasing since the start of the year and witnessed a yearly rise from 4,936,754 tons in Q3/18 to reach 9,288,583 tons in Q3/19. Meanwhile, the value of chemical or allied industries recorded a decrease of 5.90% y-o-y to settle at $1.55B and that of machinery and electrical instruments also declined by 24.81% over the same period to $1.33B. In terms of top trade partners

Lebanon primarily imported from US, China, and Russia with shares of 8.65%, 8.58% and 7.65%, respectively, in Q3/19. As for exports, the top category of products exported from Lebanon were pearls, precious stones and metals, which grasped a share of 38.89% of total exports, followed by a share of 10.09% for Machinery; electrical instruments and 9.92% for Products of the chemical or allied industries over the same period. In details, the value of pearls, precious stones, & metals surged from 505.38M in Q3/18 to reach $1.93B in Q3/19. As for the value of Machinery; electrical instruments, it recorded an increase of 25.64% year-on-year to $283.79M. Meanwhile, the value of Products of the chemical or allied industries, it increased by 4.24% y-o-y to $278.95M. In the first 9 months of 2019, Switzerland followed by the UAE and Saudi Arabia were Lebanon’s top three export destinations, respectively constituting 27.68%, 11.71%, and 6.40% of total exports. (BLOM 11.12)

5.2 Number of Tourists to Lebanon Shrank by 14.2% to 142,624 in October 2019

Civic protests erupted in the country on 17 October 2019, triggering economic and political unrest. As a result, the latest data by the Ministry of Tourism revealed the number of tourists in the month of October 2019 stood at 142,624 travelers, down by 14.2% compared to October 2018. Nonetheless, the cumulative number of tourists rose by 5% year-on-year (YOY) to 1.75M tourists in the first ten months of the year.

On a monthly basis, the down tick in overall tourists in October 2019 alone revealed the sharpest falls of 11.1% and 21.5% in tourists from Europe and the Arab countries, such that these respectively stood at 55,433 and 40,325 travelers in October. Tourists from the Americas also fell by an annual 3.5% to 20,934 over the same period.

Meanwhile, the increase in the cumulative number of tourists first ten months of the year revealed that Europeans constituted the largest portion of total tourists, grasping a lion’s share of 36.7%, while travelers from the Arab countries came in second with a share of 30.6%, tourists from the Americas had 18.8% and Asia comprised 6.8% of total tourists. (MoT 15.12)

5.3 Number of Lebanese Construction Permits Slumps by 19.37% in November 2019

The civic protests that erupted starting on 17 October across Lebanon and the ensuing financial and economic developments negatively impacted the real estate and construction sector over the period, as shown by the latest figures released by the order of engineers of Beirut and Tripoli. In fact, the total number of construction permits dropped by an annual 19.37% to stand at 10,354 permits by November 2019. The respective Construction Area Authorized by Permits (CAP) in its turn slumped by a yearly 32.06% to 5.7M sqm., corroborating investors’ affinity for smaller construction areas for their projects. (BLOM 24.12)

5.4 Jordan’s Trade Balance Deficit Drops by 14% in 10 months

Jordan’s trade balance deficit decreased by 14% over the last 10 months, compared with the same period in 2018. According to figures released by the Department of Statistics, the trade balance deficit in the last 10 months stood at JOD 6.392 billion. According to the data, the Kingdom’s total exports increased during the mentioned period of 2019 by 8.6% compared to the same period of 2018, recording about JOD 4.882 billion. The value of national exports during the past ten months amounted to JOD 4.136 billion, while the value of re-exports amounted to JOD 746 million. On the other hand, during the past ten months, imports decreased by 5.5% compared with the same period of 2018, declining to about JOD 11.274 billion. (Petra 23.12)

5.5 Jordan & USAID Sign $745 Million Grant Agreement

On 15 December, the Jordanian Government signed an agreement with the United States Agency for International Development (USAID), under which the US agency will provide a $745.1 million cash grant to the Kingdom’s treasury. The grant is part of the 2019 US economic assistance package to Jordan. This grant will be part of the 2019 budget to support priority development projects listed in the 2019 General Budget Law, which would contribute to reducing the budget deficit. The grant value is expected to be received before year end.

The USAID program in Jordan is one of the agency’s largest and most diverse programs in the world. Noteworthy, the total economic (non-military) assistance provided to Jordan by the United States for 2019 is about $1.15 billion, up by about $300 million over the indicative value of economic aid set out in the memorandum of understanding that governs US aid to the Kingdom during the period 2018-2022, which was signed in February 2018. The remaining sum of economic aid for 2019, which amounts to nearly $400 million, will be used to support economic development, provide employment opportunities, boost the social sector, and promote local development. It will also include $50 million allocated to the Kingdom by the US Congress as additional support within the aid fund. (Petra 15.12)

►►Arabian Gulf

5.6 Saudi Arabia & Kuwait to Sign Deal to Restart Production at Oilfields

On 24 December, Saudi Arabia and Kuwait signed a deal to resume production at two major oilfields in a shared neutral zone after five years of stoppage. The Kuwait Gulf Oil Company (KGOC) said the signing ceremony took place in the neutral zone where the offshore Khafji field and onshore Wafra field are located. The two fields were pumping some 500,000 barrels per day before production was halted first at Khafji in October 2014 and then at Wafra months later over a dispute between the two Arab Gulf neighbors. Riyadh said at the time the decision was due to environmental issues.

The oil produced in the neutral zone in the border area is shared equally between the two nations. Khafji was jointly operated by KGOC and Saudi Aramco Gulf Operations, while Wafra was operated by KGOC and Saudi Arabian Chevron. It was not immediately specified when the two fields will start pumping again, but the agreement comes as oil prices are under pressure due to abundant reserves and weak global economic growth. The slump has prompted OPEC and its allies to make deeper production cuts starting next month. (AB 24.12)

5.7 Qatar Budget Surplus to Shrink in 2020

Qatar, the world’s largest exporter of liquefied natural gas, will see its budget surplus shrink in 2020 due to projected higher wage bills. The country ran a provisional surplus of 4.4 billion riyals ($1.21 billion) — its first surplus in three years — in 2019 due to higher energy prices. That is now expected to shrink to 500 million riyals in 2020. Expenditure is estimated at 210.5 billion riyals, up by 1.9% compared with 206.6 billion in 2019. Budget expenditures are the highest in the past five fiscal years, reflecting the country’s commitment to the completion of multiple development projects ahead of the 2022 World Cup. A 3.3% hike in the government wage bill was due to a hiring spree for newly completed education, health and railway projects.

Qatar has been under an economic and diplomatic boycott by neighboring countries led by Saudi Arabia for the past two-and-a-half years although signs of reconciliation efforts have recently emerged. Saudi Arabia, the United Arab Emirates, Bahrain and Egypt severed ties with Qatar in June 2017, accusing it of links to extremist groups and being too close to Iran. Doha has denied the charges and increased business with existing trade partners outside the region, announced plans to produce more gas and sought new markets. Qatar, the third largest economy in the Gulf, has also sought to secure new revenues to boost income streams that shrank due to the slump in oil prices after mid-2014. (Various 17.12)

5.8 UAE Leaders Reveal Plan to Develop Strategy for Next 50 Years

Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, and Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi, announced 2020 to be the year of preparations for the next 50 years. Declared “2020: Towards the next 50,” next year will witness the biggest national strategy to prepare for the coming 50 years on the federal and local level as the country approaches its Golden Jubilee in 2021.

Sheikh Mohammed issued directives to form two committees. The 50-year Development Plan committee, chaired by Sheikh Mansour bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidential Affairs, is tasked with involving all segments of the society in shaping life in the UAE for the next 50 years. It will draw a new economic map for the UAE and develop “exceptional projects and policies” to make giant leaps in the national economy. It will also work on cementing the soft power of the UAE and establishing media systems to share the country’s new story with the world, bringing economic and social returns that protect its gains and enhance opportunities in the new economy.

Among the committee’s other responsibilities is developing vital sectors including health, education, housing, transport and food security across the country to increase future readiness. The committee will also develop a comprehensive vision of the UAE society in the next 50 years that adapts demographics, family life and cultural identity to a rapidly-changing world.

The second committee, the Golden Jubilee Celebrations committee, will be chaired by Sheikh Abdullah bin Zayed Al Nahyan, Minister of Foreign Affairs and International Cooperation, with his deputy Sheikha Mariam bint Mohamed bin Zayed Al Nahyan. It will be tasked with overseeing all Golden Jubilee celebrations involving the private sector and involving embassies across the country. The committee’s responsibilities also involve setting mechanisms to coordinate events and activities on a federal and local level. (AB 14.12)

5.9 USA, UK and France Top List of Visitors to Dubai in Third Quarter

Travelers from the USA, UK and France topped the list of visitors to the UAE in the third quarter of 2019, according to the latest data from Expedia Group. The top ten feeder markets for the UAE also included India, China, Ireland, Australia, Germany, Italy and Brazil. Figures for Q3/19 showed particular demand from Brazil and Portugal, reflecting the Emirates codeshare partnership with LATAM Airlines and direct flights to Porto. While travelers from China showed a 50% year-on-year growth in package demand. A surge in arrivals into Dubai was recorded over the summer months resulting in 12.08 million international overnight visitors in the first nine months of 2019, according to data released by Dubai’s Department of Tourism & Commerce Marketing. According to the Central Bank’s Third Quarter Economic Review and Dubai Tourism data, approximately 56.3% – or 6.8 million – of tourists who arrived in Dubai between January and September 2019 stayed at the emirate’s hotels. (AB 15.12)

5.10 UAE Tax Revenues Exceed $6.8 Billion, 5.5% of Public Purse

Tax revenue, including VAT, amounted to 5.5% of the UAE’s total public revenue last year, while oil revenues and the profits of public joint-stock companies accounted for 36.1% and 32.9% respectively, according to the Ministry of Finance. The ministry said the UAE’s decision to apply VAT was positively reflected in the country’s overall budget. Total revenues in the government budget amounted to AED456 billion ($124 billion) in 2018, including tax revenues worth AED25 billion ($6.8 billion). It added that 2018 witnessed a budget surplus of 2.2% compared to deficits of 0.2%, 1.3% and 6.4% in 2017, 2016 and 2015.

The UAE Government adopted a VAT rate of 5% at the start of 2018 to promote economic growth in isolation from oil revenues and increase the state’s ability to continue providing educational and health services and public facilities. Recent studies by the ministry pointed out that the budget surplus in 2018 resulted from the growth of general revenue by 13.3%, which surpassed the rate of public spending growth of 4.2%. (AB 11.12)

5.11 UAE’s Khalifa Port to Get a $1 Billion Upgrade

Khalifa Port, situated halfway between Abu Dhabi and Dubai, was officially inaugurated on 12 December 2012, by UAE President Sheikh Khalifa bin Zayed Al Nahyan. Seven years later, an investment of AED2.2 billion will be made in the development of South Quay and Khalifa Port Logistics, as well as an AED1.6 billion expansion at Abu Dhabi Terminals. The South Quay development, which will be completed by the first quarter of 2021 comprises a 3 km. quay-wall with 18.5 meters alongside draft for general cargo, ro-ro and bulk usage. It will also include eight berths and 1.3 million square meters of the terminal yard.

The Khalifa Logistics expansion will encompass a 3.1 km. quay wall with an 8-metre draft, 15 berths and land plots, which can be tailored to individual customers. Phase 1 of the South Quay expansion will be completed by Q4/20, while phase 2 and the Khalifa Logistics expansion will follow a few months later. These two projects will create more than 2,800 direct and indirect jobs and contribute more than AED3.2 billion to the emirate’s GDP by 2025.

With this capacity expansion project in place, Khalifa Port will see its container handling capacity jump from the current 5 million to 7.5 million TEUs, which sets it firmly on the path towards its 9 million TEU milestone over the next five years. Khalifa Port will be the first in the UAE to be linked to the new Etihad Rail network, which is currently under construction. (AB 12.12)

5.12 Overseas Tourism Worth Nearly $28 Billion to Dubai

Dubai has been ranked the third biggest city in the world for international tourism spending with a total of $27.9 billion, according to a new report from the World Travel & Tourism Council (WTTC). The council, which represents the global travel and tourism private sector, has released its Cities Report for 2019, which reveals that the Middle East & North Africa (MENA) contributed $92 billion to the global tourism GDP. The report revealed many cities across MENA make a significant contribution to the city’s overall GDP, with Marrakech’s travel and tourism sector contributing 30.6% and Dubai contributing 11.5%.

According to the WTTC, Dubai and Riyadh are the most reliant on international visitor spending in the region, with 89% and 86% respectively of the total travel and tourism spend coming from international visitors. Additionally, Riyadh sees its international spending per visitor nine times higher than domestic spending.

In terms of employment, the report showed MENA to be performing particularly well with three of the top 10 fastest growing cities for employment located within the region, including Dubai. Of the top five cities for fastest growth in travel and tourism employment between 2008-2018, Abu Dhabi comes in first with 8% growth, with Riyadh (5.9%) in third place. It also highlighted the Saudi city of Mecca for its more balanced split between domestic and international demand – 48% international and 52% domestic. (WTTC 17.12) (DNE 28.11)

5.13 Expo 2020 Forecast to Continue to Drive Dubai Construction Growth

Expo 2020 and government-led infrastructure projects were key factors driving the growth of Dubai’s construction sector in 2018 and 2019 and this is expected to continue over the next two years, according to a new report. Analysis released by Dubai Chamber of Commerce and Industry, based on recent data from BNC, IMF, Haver Analytics and Fitch Connect, revealed that the construction sector contributed an estimated 6.4% to Dubai’s GDP in 2018. It added that there are 4,792 current active projects in Dubai, accounting for 42% of the UAE’s total.

Other key growth drivers for Dubai’s construction market include the emirate’s strong economic fundamentals and diversification strategy, steady increase in population and number of tourists, sustained infrastructure investment over the medium term and major government investments in transportation, the report noted. It also said that most Expo 2020 related infrastructure projects are either under construction or completed, while the majority of the contracts are for building works located at the Expo site. Other mega projects include expansions of Al Maktoum International Airport (DWC), Jebel Ali Port and the Dubai Metro Red line connecting the city center to the Expo 2020 site.

The findings also showed that the UAE leads the GCC in the value of awarded contracts for 2019 as the country is estimated to have $48.4 billion worth of contracts in the pipeline, followed by Saudi Arabia ($40.2 billion) and Kuwait ($15.8 billion). The UAE also outperforms other countries in the region when it comes to the contribution of its construction sector to national GDP with the value of this figure reaching $33.2 billion in 2018. (AB 14.12)

5.14 Saudi Unemployment Drops to Lowest in Three Years

According to the General Authority for Statistics, Saudi Arabia’s citizen unemployment rate fell to the lowest in more than three years as the kingdom’s non-oil economy gradually recovers from a slowdown. Joblessness slipped to 12% in the third quarter from 12.3% in the previous three months. Unemployment dropped for both men and women – though Saudi female unemployment remains over 30% as more women enter the labor force seeking jobs.

Saudi Arabia’s unemployment is a key indicator watched by officials as they try to create jobs for nationals in a private sector dominated by foreign labor. Until now, improvements in the labor market have continued to lag a rebound in non-oil growth this year to the fastest since 2015, a reflection of the persistent weaknesses in business confidence that’s been made worse by a string of fiscal reforms such as new taxes and fees. Joblessness among nationals has held at or above 12% for the past three years, especially testing the patience of young Saudis entering the labor market. (GAS 15.12)

5.15 Saudi Arabia May Tap International Debt Markets to Fill Budget Gap

Saudi Arabia may tap international debt markets as early as next month as the kingdom seeks funding to help bridge its widening budget deficit. Most of the debt will be local and about 45% will be raised overseas through sukuk and conventional bonds, the head of the Finance Ministry’s debt management office said. The country will refinance roughly SR44 billion ($11.7 billion) of existing debt.

Saudi Arabia expects its budget deficit next year to rise to SR187 billion and plans to finance that with debt and drawing down the kingdom’s reserves. The new budget marks a shift away from the fiscal stimulus that helped power non-oil economic growth this year to the fastest since 2015. The world’s largest oil exporter is embarking on three years of spending cuts as it looks to private businesses to take the lead. (AB 11.12)

►►North Africa

5.16 Remittances to Egypt Reach $6.7 Billion in First Quarter of FY 2019/20

Remittances from Egyptian expatriates increased in the first quarter of the 2019/2020 fiscal year to reach $6.7 billion, the Central Bank of Egypt announced on 17 December. Remittances increased by 13.6% year on year in the quarter, up from $5.9 billion in the first quarter of the 2018/2019 fiscal year. Remittances are one of the country’s main sources of foreign currency. (Ahram Online 17.12)

5.17 Egypt’s Economy to Strengthen in 2020 With 15% Rise in Profit Growth Rate

Hermes Financial Group, one of the leading investment banks in the Middle East and Africa, forecast that the Egyptian economy will become stronger and will be based on solid grounds in 2020 due to the Egyptian economic reform program that succeeded in creating an appropriate business atmosphere. In its annual report, Hermes said the Egyptian market is likely to lead emerging markets in the Middle East in 2020 with an expected 15% profit growth rate. Exchange prices are expected to return to their previous rates before the liberalization of the Egyptian pound, it added.

It said restructuring energy prices in July helped the government to go ahead with doubling wages’ minimum rates, boosting local products and increasing pensions. Fiscal deficit is likely to decrease within the next two years due to decline of interest rates that will lower borrowing costs, it added. Hermes group expected that the pound price will be more stable against the dollar and that the total deficit will hit 2.9% of GDP thanks to improvement in the tourism sector.

Companies planning to expand are expected to achieve more profits in 2020 prompted by the decrease of interest rates, it said. Hermes expected a relative recovery of the cement sector and an increase in the profits of communications companies operating in Egypt that showed an excellent performance in 2019. (EFG Hermes 15.12)

5.18 Egypt’s Trade Deficit Narrows by 28.7% in September

Egypt’s trade deficit value reached $3.49 billion in September 2019, down from $4.9 billion during the same month the previous year, making a decline of 28.7%, according to CAPMAS. Unfortunately, Egypt’s export value decreased by 2.7% in September, amounting to $2.37 billion during September, down from $ 2.43 billion in September 2018, the CAPMAS added. CAPMAS attributed the decrease in the export value to the decreased value of some commodities such as fertilizers by 32.5%, fresh fruits by 7.9%, carpets by 8.5% and other varieties of textile materials by 7.1%.

Export values of some commodities increased during September 2019, versus the same month the previous year such as crude oil by 1.2%, petroleum products by 5.2%, ready-made clothes by 11.7%, plastics in primary forms by 7.6%. In addition, CAPMAS showed that Egypt’s import value decreased by 20.1%, recording $5.86 billion, down from $7.33 billion during the same month last year.

The CAPMAS attributed the decrease in Egypt’s import value to the decreased value of some commodities, including petroleum products by 37%, raw materials of iron or steel by 12.6%, plastics in primary forms by 15.9%, and organic and inorganic chemicals by 1.2%. Meanwhile, imports of some commodities increased in September 2019, versus the same month previous year such as wheat by 12.8%, pharmaceuticals and pharmaceutical preparations by 8.6%, meat by 12.4% and corn by 26.6%. (CAPMAS 17.12)

5.19 Egypt Signs $466.3 Million Locomotive Deal with Progress Rail

Egyptian National Railways (ENR) signed a $466.3 million deal with Progress Rail, an Alabama based subsidiary of Caterpillar, on 15 November regarding the supply and refurbishment of locomotives. The deal involves the supply of 50 EMD diesel locomotives, modernizing 50 diesel locomotives from ENR’s existing fleet and overhauling another 41 locomotives. ENR will fund the overhaul of the 41 locomotives at an estimated cost of $27 million. Progress Rail will also take over responsibility for the long-term maintenance of all 141 locomotives.

The new EMD locomotives are scheduled for delivery within 22 months of the activation of the contract, while the 50 ENR locomotives will be modernized within 30 months. (IRJ Pro 19.12)

5.20 Egypt & USAID Sign a Second Phase of North Sinai Development Initiative Agreement

On 17 December, Egypt and the USAID signed an agreement for an additional $6 million for the North Sinai development initiative, bringing the total in the bilateral assistance program to the governorate to $56 million. The agreement aims at achieving major social and developmental improvement for citizens in North Sinai through providing safe drinking water and sanitation services for around 100,000 residents, in addition to upgrading the infrastructure in order to attract investments. The Egyptian government’s priorities include the empowerment of young people and women, supporting SMEs, improving drinking water and sanitation, and expanding social protection programs through implementing development projects in all sectors, especially in infrastructure, new road networks, social housing, healthcare, and education. (Ahram 17.12

5.21 World Bank Loans Morocco $275 Million for Disaster Management Program

On 11 December, the World Bank approved a loan of $275 million to Morocco for its Disaster Risk Management Development Policy, developing its response to the impact of natural disasters and climate-related shocks. The loan also aims to help Morocco to develop a Deferred Drawdown Option for Catastrophe Risks (Cat DDO) to manage the financial impact of natural disasters. The fund is a critical tool which complements private insurance by providing compensation to the uninsured, such as the poor and most vulnerable.